The 5-Minute Rule for "Maximizing Your Earnings Through Proper Paycheck Stub Analysis"

Understanding View Details : A Complete Guide

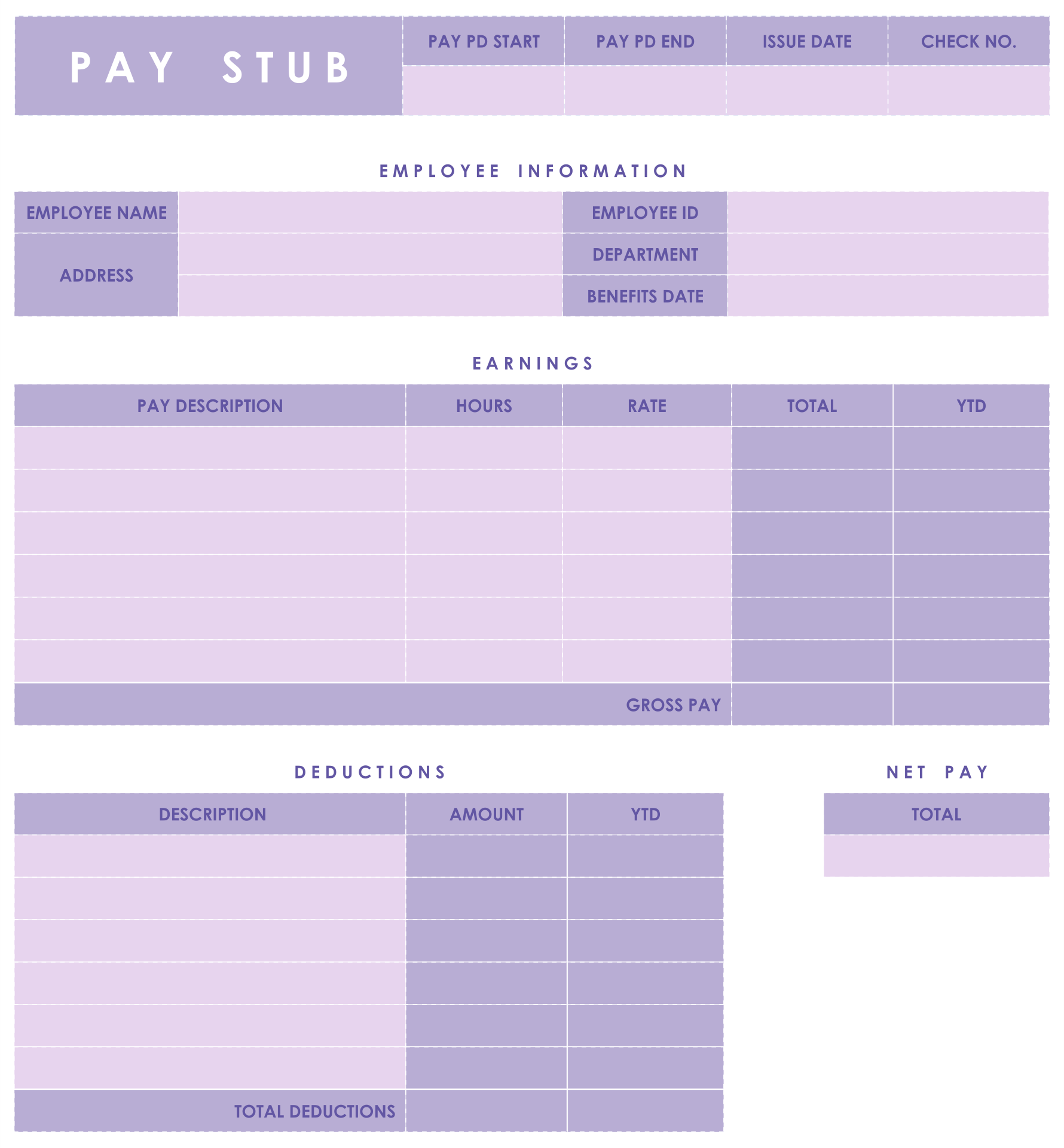

Your paycheck stub is an essential record that provides you along with a comprehensive failure of your earnings and reductions. It is important to recognize your salary stub to make sure that you are being paid for properly and to always keep keep track of of your funds. This manual will certainly supply a total introduction of how to reviewed and comprehend your payday stump.

1. Gross Pay

The very first product on your payday short end is gross pay, which is the total volume of funds you gained before any reductions or income taxes were taken out. This includes all wages, overtime wages, bonuses or compensations gained during the income time frame.

2. Federal government Taxes

Federal government earnings tax is one of the very most substantial deductions coming from your salary. The quantity taken off relies on your documents condition, revenue amount, and amount of allowances declared on Form W-4. Your payday might likewise feature other federal income taxes like Social Security tax and Medicare income tax.

3. State Taxes

If you live in a state with an income tax, state tax obligations are deducted from your payday as well. The amount withheld varies depending on the state’s income tax prices and exceptions.

4. Local Tax obligations

Some metropolitan areas or districts likewise impose regional tax obligations, which are subtracted coming from employees’ paychecks who operate within their legal system.

5. Social Security and Medicare

Social Security and Medicare tax obligations are pay-roll taxes that fund courses for retired or disabled individuals and those receiving health care treatment advantages by means of Medicare.

6. Retirement Contributions

If you get involved in an employer-sponsored retirement life planning like a 401(k), contributions will be taken out of each salary immediately according to the portion you picked when signing up in the course.

7. Health Insurance Premiums

If you have health and wellness insurance coverage via your company, premiums will be deducted coming from each paycheck based on the insurance coverage degree decided on at application time.

8. Various other Deductions

Other reductions may feature union dues, wage garnishments for kid assistance remittances or trainee loans, vehicle parking fees or other perk premiums.

9. Internet Pay

Internet pay is the quantity of money you take home after all deductions and tax obligations have been taken out. This is the ultimate quantity deposited in to your financial institution account or issued as a paper inspection.

10. Year-to-Date (YTD) Info

Your payday stub are going to likewise include year-to-date information that presents how a lot you have gotten and how a lot has been reduced coming from your incomes since the beginning of the schedule year.

11. Pay Period Dates

Your salary stub will certainly show the beginning and end day for the salary time frame, as well as the time on which your payday was released.

12. Employer Information

Your employer’s label, deal with, and federal government income tax ID variety will also be presented on your salary stub for reference objectives.

Understanding Your Paycheck Stub: Why It Matters

It’s essential to recognize your salary short end because it helps you to:

- Make sure that you are being paid for precisely

- Maintain keep track of of how much amount of money you are earning

- Understand where your funds is going

- Strategy for retirement life by examining additions to retirement life plans

- Figure out whether health and wellness insurance coverage fees are being taken off accurately

- Verify that income taxes are being concealed effectively

In final thought, understanding your payday stump can easily help you handle your financial resources extra efficiently and stay away from any kind of unpleasant surprises when it comes to income tax season or other economic situations. Through taking some time to assess each thing specified on your paystub, you may ensure that everything is exact and help make adjustments if required.